I have met more than a thousand founders in recent years. Here are my two cents for early-stage startup founders.

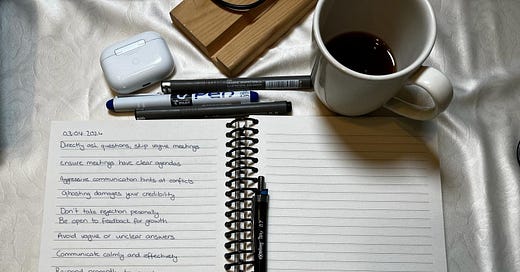

Communication and Transparency

Directly ask questions, skip vague meetings.

Ensure meetings have clear agendas.

Aggressive communication hints at conflicts.

Ghosting damages your credibility.

Be open to feedback for growth.

Don't take rejection personally.

Avoid vague or unclear answers.

Communicate calmly and effectively.

Respond promptly to investors.

Delayed responses signal poor time management.

Founders should manage fundraising communication.

Direct founder contact is crucial.

PA fundraising use suggests poor time management.

Using intermediaries limits direct contact.

Refusing information shows lack of transparency.

Professionalism and Presentation

Use company emails for communication.

Organize your data room neatly.

Monitor your social media closely.

Update LinkedIn with current roles.

Quality LinkedIn profiles help investors vet you.

Accurately represent your education.

Good demo day video prep shows audience regard.

Avoid full check-boxes in competition slides.

Don't mention on your presentation how you plan to exit.

Strategic Planning and Focus

Focus on impactful metrics, not vanity numbers.

Early stage? Short-term forecasts only.

Value real achievements over titles.

Beware getting distracted by events.

Have realistic market entry plans.

Over-optimism and weak plans seem risky.

One commitment for full focus.

Team and Founder Dynamics

Disclose family ties among founders early.

Equity for passive co-founders is a red flag.

Focus on core team quality, not size.

Co-founder conflicts are a potential red flag.

Resolve co-founder conflicts early.

Co-CEOs hint at power struggles.

Avoid power struggles, clarify roles.

Ensure decision-making power matches equity.

No technical co-founder risks product development.

Co-founders are part-time, juggling other projects during funding is red flag

Shallow industry knowledge is a red flag.

Financial Wisdom and Integrity

Complex cap tables can complicate future deals.

Uncapped valuations are a red flag.

Answering that valuation will be determined by the market is a red flag.

5-year revenue forecasts add little value early on.

Favor early revenue over large unvalidated spends.

Seek revenue early, spend wisely.

Luxury spending signals wrong priorities.

High risk relying on a single customer/supplier.

False urgency in relations is a red flag.

Keep SAFE agreements unmodified for trust.

Keep investor terms unchanged. Any edits must be clear and shared.

Avoid NDAs for openness in due diligence.

Aim for equitable terms for all early investors.

Transparency in fundraising intent.

Claiming not to seek funds may hide motives.

Spin-offs have unique funding challenges.