The Investor's Mindset: How to Harness the Power of Intuition and Analysis for Better Decisions

Demystifying the Cognitive Biases and Psychological Pitfalls in Investment Decision-Making

"Thinking Fast and Slow" and Early Stage Investment Decisions

While re-reading Daniel Kahneman's book "Thinking, Fast and Slow", I realized that although its content is not specifically focused on angel or early-stage investing, the part about the decision-making process actually reflects what I have long been applying in the investment process.

In this article, I tried to summarize how the theories and concepts in the book can be applied when making investment decisions and the common investor mistakes. I also shared how I make my own investment decisions and my decision-making framework.

Integrating Fast and Slow Thinking for Better Decision-Making

"Thinking, Fast and Slow" discusses two main thinking models that people use in processing information and making decisions: System 1 and System 2 thinking.

System 1 is a fast, intuitive, and automatic thinking model. It is driven by emotions and instincts. It is used for making quick decisions or responding to situations that require immediate reaction.

System 2, on the other hand, is a slow, cautious, and analytical thinking model. It is used for making important decisions that require complex information processing, problem-solving, or careful thinking.

I believe it is important to strike a balance between these two systems in order to make conscious and effective decisions, especially in early-stage investments. In early-stage investments, examples of System 1's fast, intuitive, and emotional decisions could include the following.

First impressions: Investors can be quickly influenced by a charismatic founder or an exciting product presentation. This positive first impression, driven by System 1, can affect the investment decision even without fully analyzing the business model or market potential. For example: an extroverted entrepreneur with a good presentation can impress the investor more quickly, while a quieter and more introverted entrepreneur may easily receive a rejection.

Personal relationships: An investor may tend to make decisions based on personal relationships with founders or other team members. This emotional connection can lead to investing without fully evaluating the potential of the venture. A close third party recommending or referring the entrepreneurs can easily influence the investment decision.

Investments driven by trends: An investor may feel compelled to invest in a venture that aligns with the latest trends or buzzwords, getting caught up in the excitement of the industry. Examples: Cryptocurrency, NFT, BNPL, Last Mile Delivery, AI/ML, etc. This can lead to hasty decisions without fully understanding the potential or risks of the venture.

Examples of slow, thoughtful, and logical System 2 decisions in investing can include:

Due Diligence: An investor may spend significant time researching the venture, evaluating the business model, market size, competitive landscape, and the experience and skills of the founding team with System 2 thinking.

Risk assessment: The most rational approach before investing is to evaluate potential risks related to financial, legal, market, and competition aspects and compare these risks to the potential return. Additionally, a SWOT analysis can be performed.

Risk diversification: System 2 thinking encourages carefully considering investment strategies and diversifying the portfolio by investing in ventures with different sectors, stages, and risk profiles; in other words, putting eggs in different baskets. As a result, the impact of a single investment's failure is mitigated, increasing the overall chance of success.

I believe it is important for investors to balance System 1 and System 2 thinking in order to make better investment decisions. I'm not saying that first impressions and intuition aren't valuable. I even see these factors being effective in my own decisions from time to time, but for well-informed and effective decisions, detailed analysis and logical thinking, i.e., System 2, are critically important. In my opinion, the best approach when making investment decisions is to evaluate with System 2 results in mind.

The Art and Science of Investment Selection: A Structured Decision Framework

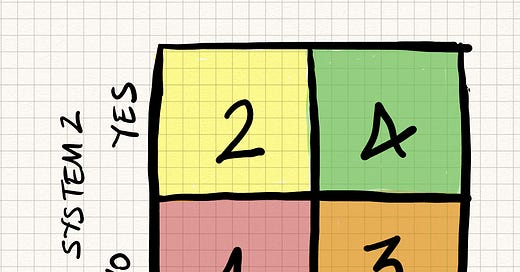

When making an investment decision, I initially use the following framework. My Investment Decision Analysis Matrix consists of 4 boxes:

Dual Rejection - Instinctive Rejection / Analytical Rejection

Cautious Consideration - Instinctive Rejection / Analytical Acceptance

Risky Intuition - Instinctive Acceptance / Analytical Rejection

Balanced Opportunity - Instinctive Acceptance / Analytical Acceptance

Dual Rejection: After our first meeting or presentation with the entrepreneur, my feelings and intuition may say "No," but this does not immediately reflect in the final investment decision. The venture is placed in the first column. If the detailed examination later also turns out negative, both System 1 and System 2 decisions become "No," and I don't invest.

Cautious Consideration: If the System 2 decision is positive, I try to understand the team or entrepreneur more thoroughly and test the accuracy of my initial intuitions. Even if System 2 may conclude that the company is worth investing in, if I feel something is wrong somewhere that I can't put into words, I try to understand why I reached this conclusion. Maybe I wasn't in the right mood when the meeting took place, or the entrepreneurs were excited and created a wrong impression. Other investors participating in the meeting may have influenced me. I may have been influenced because the impressions of an investor I know were negative. Therefore, if System 1 returns a "No," I try to analyze the venture more in-depth and closely monitor it. These ventures enter the yellow box.

Risky Intuition: If my first impression and the result of the meeting were positive, these ventures are placed in the second column. If System 1 says "Yes" and System 2 says "No," these ventures enter the orange box labeled 3. In other words, my quick, intuitive, and emotional positive decision may have been refuted by the slow, thoughtful, and logical System 2 decision. I would likely say "No" to the venture in this investment round. I follow the venture, ask for updates every 3-4 months, or talk again after 6 months. Although the orange and yellow boxes may seem similar, System 2 plays a more weighted role in my decision-making framework. The likelihood of me investing in a venture in the yellow box labeled "Careful Evaluation" is higher despite my initial impression.

Balanced Opportunity: If the results of my fast, intuitive, and automatic thinking during the first meeting with the entrepreneur and the results of my slow, thoughtful, and analytical thinking model are positive, these ventures enter the fourth box. If both system decisions say "Yes" and I didn't commit "Confirmation Bias" or "Affirmation Fallacy," I invest in this venture.

In summary: "If the answer is not a clear yes, then it means no." In the decision-making process, if I am not completely convinced before investing in a venture, if I have doubts or hesitations, I accept this as a "no" and do not invest.

Investment Decision-Making: Recognizing and Preventing Common Errors

Based on my observations, investors, whether new or experienced, can make similar mistakes during decision-making.

Relying Solely on Intuition: (Gut Feeling): A common mistake made by investors, regardless of experience, is the tendency to make decisions immediately based on System 1 results or intuition. Especially in investor networks, the person who selects and invites the venture for the presentation is also given the task of detailed research. This shows that they leave a crucial step in the decision-making process for me to a third person. Of course, the success of decision analysis depends on how experienced, knowledgeable, and careful the network manager is. My impression is that many participants in investment networks make decisions based on their intuition. This can lead to faulty decisions.

Not only new investors but also experienced ones can make mistakes in decision-making with System 1 results. Regardless of their experience in their field, I believe that an investment decision based on intuition may not be correct and a more detailed examination is definitely necessary.

Overconfidence Bias: Investors can fall into the "Overconfidence Bias" trap due to their past successes in their field. Like the example in the book 'Thinking, Fast and Slow,' many people think they are above-average drivers and, therefore, take unnecessary risks or underestimate the likelihood of accidents.

For example, the successful former CEO of a major bank has become a new angel investor. Until a few years ago, he successfully managed a budget of billions of dollars. He has accumulated experience in many areas and believes he can recognize entrepreneurs at a glance. This is overconfidence bias.

Another example is an investor who calls himself an expert angel after achieving successful results in previous investments. He may have excessive confidence in finding winning ventures. This situation can lead them to invest without sufficiently analyzing risks or making hasty decisions.

Halo Effect: One of the pitfalls encountered while making System 1 decisions is the "Halo Effect." The Halo Effect is when one characteristic of something or someone affects our perception of other characteristics. Whether an investor is an expert or a beginner, they make decisions based on the thought that other characteristics of the venture or entrepreneur are also positive, looking at a specific positive characteristic.

For example: An entrepreneur who graduated from a prestigious university may be perceived as more successful and talented by investors. This situation can lead the investor to make a quick investment decision without questioning the other aspects of the venture.

Similarly, an entrepreneur with a good appearance can create a "halo effect." Investors may fall into the perception that entrepreneurs with an attractive and impressive appearance are more successful, intelligent, or reliable. This situation can lead investors to act biased while evaluating the entrepreneur and the business idea and make a positive decision without critical thinking.

Herding Behavior: In investment networks, due to the limited presentation time and schedule during regular meetings, group pressure and herding behavior can play a role. Investments can be influenced by the decision of the most influential speaker or the investor member with the highest reputation in the room.

Fear of Missing Out (FOMO): It is a psychological state in which individuals experience anxiety or stress due to the perception of missing out on profitable opportunities or experiences. In the context of investment, FOMO can lead to pursuing seemingly attractive investments without proper evaluation at individual or investment network meetings or making hasty decisions.

Easy Recall Tendency (Availability Heuristic): This bias involves evaluating the success chances of an investment based on how easily examples in the entrepreneurial world can be recalled. Investors can focus too much on recent major successes or failures, influencing their own investment decisions. Investors should strive to base their decisions not only on stories but also on comprehensive data. If certain types of ventures, such as Getir, Gorillas, Weezy, Flink, etc., fast delivery services or quick grocery delivery startups, have been highly visible in the media lately due to their success, the investor may believe that the sector is growing and successful investments are more likely.

Confirmation Bias: Another mistake often made when the System 1 decision is yes is the "confirmation bias." People have a tendency to search for information that confirms their existing beliefs and disregard information that refutes these beliefs.

An investor may become interested in a venture after the first presentation or meeting. While conducting detailed research (due diligence), they may focus more on information that supports their positive views on the venture and ignore red flags or warning signs. To avoid confirmation bias, the investor should actively seek different perspectives and be open to changing their ideas based on new information.

One of the best solutions here is to establish a network of experienced and expert investors, advisors, and mentors who can provide important information, connections, and support during and after the investment process.

If System 1 says yes in their investment processes, they should definitely share the summary information of these ventures with the network around them. They may even talk to other investors. Sometimes, they conduct follow-up meetings with the ventures together with these experts. The decisions of this support network are not my final decision here. It forms the inputs of the function in my overall decision-making framework. In other words, no matter how expert the person I talk to is in their field, I do not make an investment decision based solely on their thoughts.

Quantifying Investment Prospects: The Weighted Decision-Making Matrix

If we scale the System 1 and System 2 decisions I described in my decision-making table above not only as "Yes" or "No," but as a range instead of just 0 or 1, the decision-making behavior becomes a bit more challenging. In fact, this is what real life is like.

In this new table, I use a 100-point scale. I place the ventures I evaluate on the X-Y axis according to the scores they receive. For example: after a detailed analysis of a venture, there is a competitive risk, but the team is good. Then the System 2 score might be 70. You can also give a first impression score between 0 and 100 during the first meeting. Converting your intuition into numbers is genuinely difficult. Now, ventures are not just randomly placed in boxes. They start to take their places on the X and Y axes. It becomes more challenging to decide on ventures close to the border values. The inclination I give to ventures generally diverges toward the average in both decision variables.

Ventures may approach the X and Y intersection or the 1st, 2nd, and 3rd boxes. It can be challenging to decide on these ventures. If I find some ventures close to the risky area, I reduce the investment amount and invest in the venture. I believe that the potential gains from high-risk, high-return investments that investors do not participate in are greater than the total value of the investments they reject.

In his book, Daniel Kahneman mentions "Loss Aversion" and says that people generally feel the pain of loss more intensely compared to an equivalent gain. This can cause investors to be excessively conservative when making decisions and avoid potentially high-return investments due to fear of loss. In my opinion, to prevent this, investors should focus on the long-term potential of their portfolios and implement a diversified investment strategy. Therefore, if ventures are barely passing in both System 1 and System 2, I reduce the investment amount and invest.

Arriving at the Ultimate Investment Decision: How do I reach the final decision?

Although this framework tries to reduce uncertainties, as an investor, remember that you are making decisions under significant uncertainty. Moreover, the evaluations you give flow like a river, changing over time, and are not static.

I know that decision-making within the framework I described is multi-layered and detailed. To avoid "Analysis Paralysis," I always set a deadline for investment decisions. I focus on critical and essential factors. I use the decision-making framework I mentioned and do not rely solely on my intuition. I also evaluate the consequences of indecision. A bad decision is even better than the burden of indecision.

Sleeping On It or Incubating: Before making the final decision, I incubate all my results. That is, I sleep on all my evaluations for a few nights. This expression may seem like procrastination when you hear it. It is widely used in everyday life. The idea behind it is that taking a break to rest and sleep allows the brain to process information and emotions more effectively, improving the decision-making process. "Decision-making by sleeping" helps me regulate my emotions and prevents most of the hasty or wrong decisions I make under stress. I believe that if I sleep with a problem, I solve it more easily during sleep and find creative solutions. In conclusion, it improves my decision-making process.

Summary:

Balancing System 1 and System 2 thinking is essential when making investment decisions.

First impressions and intuition alone are not valuable for decision-making. Detailed analysis and logical thinking, i.e., System 2, are critical for making effective decisions.

If the answer is not a clear yes, then it means no.

Investors can make many cognitive errors during decision-making: relying solely on intuition, overconfidence bias, halo effect, herd mentality, FOMO, availability heuristic, confirmation bias.

Investors can make better decisions by establishing a support network consisting of advisors, mentors, and experienced investors, and balancing their intuitive and analytical thinking during the investment process.

Sleep has a positive effect on the decision-making process.

The proverb "Measure twice, cut once" offers essential advice for careful and diligent planning to prevent mistakes during the investment process.