What $91 B in U.S. VC Really Means for the Rest of Us

Reading Between the Graphs: A Global Take on Q1 Venture Hype

I read the PitchBook-NVCA report from start to finish. The graphs alone make it look like venture funding is healthy again, but the deeper numbers tell a different story. When you dig into the data, a new picture appears. Here’s what I found.

Big Picture

$91 billion went into U.S. start-ups, but most of it went to just 10 huge AI deals. Smaller companies still struggle to raise money.

Hardly any exits. Only 12 VC-backed companies went public, so investors are still waiting to get paid back.

LPs are cautious. New VC funds raised only $10 billion—the slowest quarter in ten years.

Less dry powder. Unused VC capital fell to about $290 billion, which could push prices down later this year.

Macro worries. Trade tariffs and a shaky stock market make late-stage start-ups delay IPO or sale plans.

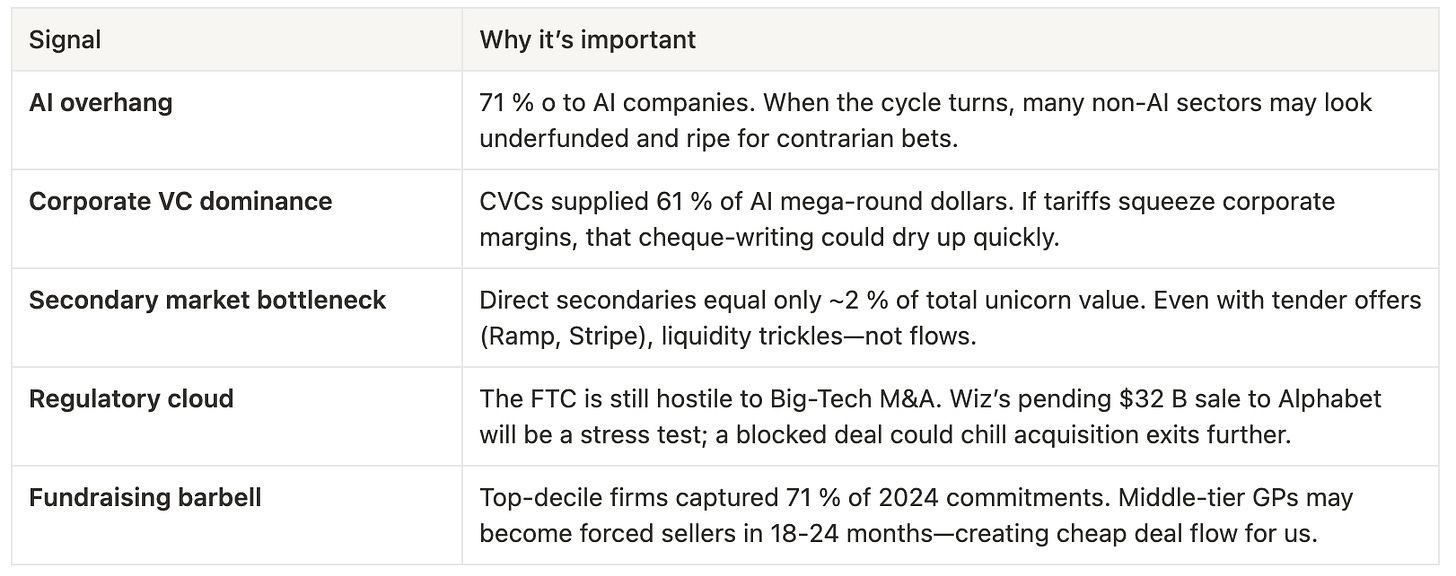

Hidden Signals

AI is soaking up cash. Over 70 % of VC money chased AI; other sectors may now look cheap.

Corporate VCs are key backers. If big companies cut budgets, AI mega-rounds could dry up fast.

Secondary sales are tiny. Only about 2 % of unicorn value trades on the secondary market, so employees can’t cash out easily.

Regulators matter. If the FTC blocks big-tech takeovers (watch the Wiz–Google deal), M&A exits will get even tougher.

Money flows to the top. Around 70 % of new LP cash goes to elite funds; mid-tier VCs may need to sell stakes cheap in the next two years.

What the U S. numbers mean for the rest of the world

Keep reading with a 7-day free trial

Subscribe to Startup Istanbul to keep reading this post and get 7 days of free access to the full post archives.