I recently had the honor of speaking with legendary venture capitalist Tim Draper on my podcast. Tim has an incredible track record, having backed companies like Hotmail, Skype, Tesla, Coinbase, Robinhood, and many other household names. Our wide-ranging discussion touched on everything from Tim's investment philosophy, to the future of cryptocurrencies, to advice for entrepreneurs.

Here are 7 key takeaways from my conversation with Tim Draper:

Make investment decisions based on instinct and entrepreneur's passion, not just data.

Think globally about startups from the very beginning to have a competitive advantage.

Continuously innovate VC models to keep pace with new technologies like AI.

Focus on industries that are stagnant and complacent to find the best disruption opportunities.

Embrace failure throughout the startup journey in order to ultimately succeed.

Develop confidence and perseverance as an entrepreneur in the face of obstacles.

Crypto has huge potential to transform commerce and remove inflationary pressure from fiat currencies.

Tim Draper's Investment Philosophy

How does Draper evaluate early stage investments, and how much does he rely on data vs intuition? He looks at entrepreneur's background, but early stage is mostly instinct.

What are his thoughts on having an investment committee vs partners making decisions? He finds a single decision maker performs better than large committees.

Has he lost deals due to investment committees? Yes, extraordinary companies got turned down, prompting him to go solo.

Advice for Emerging VC Managers

What are common early mistakes for emerging VC investors? Thinking it's easy, lack of deal flow and judgement. Need to see companies globally.

How should new managers raise money? Start with your own money, then go outwards in concentric circles to friends, family, and eventually institutions.

What other advice does he have? Diversify investments, don't over-commit. Move on quickly from failures.

Assessing Global Markets

How does he evaluate emerging markets? Focuses on innovation via the Draper Innovation Index. Also looks for moves toward capitalism and strong, entrepreneurial leadership.

The Future of Technology

Is Silicon Valley losing dominance to new tech hubs? Yes, it's losing its edge compared to other innovative regions.

How will VC evolve in the face of new technologies? He's using AI for diligence. Sees huge potential in sectors like education.

Where are the biggest crypto opportunities? Consolidation around Bitcoin as a standard for payments and commerce.

What's the right approach for crypto regulation? Regulate based on opportunity, not fear. React only when real damage has occurred.

Entrepreneurship Advice

How does Draper University encourage embracing failure? Their pledge includes "I will fail and fail again until I succeed."

What are the most important skills Draper teaches entrepreneurs? Confidence and perseverance.

It was fascinating to get Tim's take on the trends shaping the future of technology and investing. I'm grateful he took the time to share his wisdom.

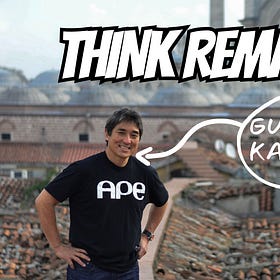

Think Remarkable

I'm thrilled to have the chance to have an in-depth conversation with Silicon Valley legend Guy Kawasaki on the podcast. As one of the original Apple employees in the early days of the tech revolution, Guy has a wealth of wisdom to share from his decades of experience as an entrepreneur, author, and innovator.

Share this post